As the Corporate Tax landscape in the United Arab Emirates (UAE) evolves, businesses are navigating new requirements, including the Corporate Tax Registration process. For companies aiming to secure the coveted Golden Visa through the Esaad Card, understanding these tax regulations is crucial. Let’s delve into the essentials, including key dates, processes, and implications.

Understanding Corporate Tax in UAE

The UAE introduced Corporate Tax as part of its efforts to diversify revenue sources and enhance its economic resilience. The introduction of this tax marked a significant shift, especially for businesses used to operating in a tax-free environment. Now, companies engaging in certain activities need to register for Corporate Tax and comply with the regulations set forth by the authorities.

What is Corporate Tax Registration?

Corporate Tax Registration is the process by which eligible companies in the UAE declare their taxable income and ensure compliance with the tax laws of the country. The Federal Tax Authority (FTA) oversees this process, aiming to streamline tax administration and promote transparency.

Key Points for Corporate Tax Registration:

- Deadline for Registration: The Corporate Tax Registration Deadline for eligible businesses in the UAE is approaching. Companies engaging in specific activities are required to register by the specified date to avoid penalties.

- Who Needs to Register? Businesses that meet certain criteria, such as reaching the annual Corporate Tax threshold, must initiate the registration process. It is essential to assess your company’s activities and determine if registration is necessary.

- Esaad Card for Golden Visa: For companies seeking the Golden Visa through the Esaad Card, Corporate Tax Registration is a prerequisite. This card offers a host of benefits for investors and professionals, including long-term residency in the UAE.

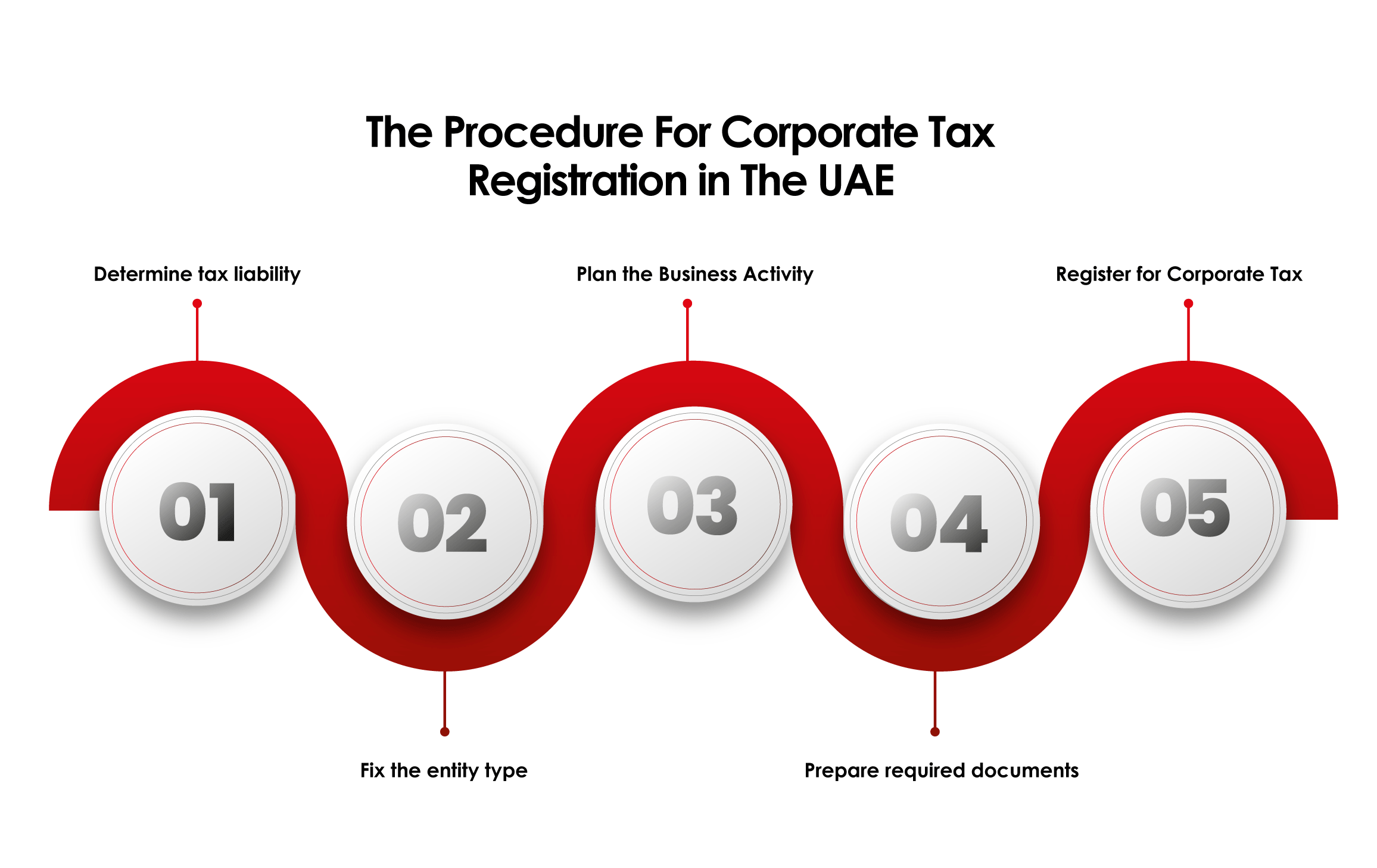

How to Register for Corporate Tax:

- Prepare Documentation: Gather necessary documents, such as trade licenses, financial statements, and shareholder details.

- Online Registration: The FTA provides an online portal for Corporate Tax Registration. Companies need to create an account, fill in the required information, and submit the necessary documents.

- Compliance and Reporting: Once registered, businesses must adhere to the reporting requirements, including filing tax returns and maintaining accurate records of financial transactions.

FAQ’s:

Q: What is the Corporate Tax Registration Deadline in the UAE?

A: The Corporate Tax Registration Deadline varies based on the company’s fiscal year-end. However, it is crucial to register promptly upon meeting the eligibility criteria to avoid penalties.

Q: Is the Esaad Card linked to Corporate Tax Registration?

A: Yes, for businesses aiming to obtain the Golden Visa through the Esaad Card, Corporate Tax Registration is a prerequisite. This step demonstrates compliance with UAE tax laws.

Q: What are the Penalties for Non-Compliance with Corporate Tax Registration?

A: Failure to register for Corporate Tax within the specified deadline can result in penalties and fines imposed by the FTA. It is advisable to seek guidance from tax professionals to ensure timely compliance.

Navigating the intricacies of Corporate Tax registration in the UAE requires careful attention to detail and adherence to regulatory requirements. By staying informed about deadlines, processes, and implications, businesses can ensure smooth compliance and focus on their growth objectives.

In conclusion, as the UAE continues to enhance its business environment, Corporate Tax registration remains a vital aspect for companies aiming to thrive in this dynamic landscape. Whether pursuing the esaad card for golden visa through the Esaad Card or ensuring compliance with tax regulations, staying updated on key dates and processes is essential for success.